GameStop, once a traditional video game retailer, has recently captured the attention of investors worldwide with its transformation into an e-commerce giant. As the stock continues to experience extreme volatility, many are left wondering whether investing in GameStop is a smart move. In this article, we delve into the challenges and opportunities ahead for GameStop and assess the impact of retail investors on the company's stock price.

Key Takeaways

- GameStop's stock price surge was fueled by retail investors on online platforms like WallStreetBets, leading to a massive increase in value.

- Industry experts caution that GameStop's business model may not be sustainable in the long run due to the shift towards digital gaming and direct-to-consumer models by console makers.

- The launch of GameStop's NFT marketplace signals a shift towards new economic opportunities in the digital space, beyond traditional video game sales.

- Investing in GameStop remains a high-risk venture, with market volatility and regulatory uncertainties playing a significant role in the stock's performance.

- Despite the hype surrounding GameStop, it is crucial for investors to conduct thorough research and consider the fundamental aspects of the company before making investment decisions.

GameStop: A Potential Investment Opportunity

GameStop's Transformation into an E-commerce Giant

18+ BeGambleAware. As we assess the investment potential of GameStop, it's crucial to recognize the company's pivot towards e-commerce. Amidst the digital revolution, GameStop has been steering away from its traditional brick-and-mortar model, aiming to establish itself as a formidable player in the online retail space. The launch of GameStop's NFT marketplace marks a significant step in this transformation, although it seemingly diverges from its core business of video game sales.

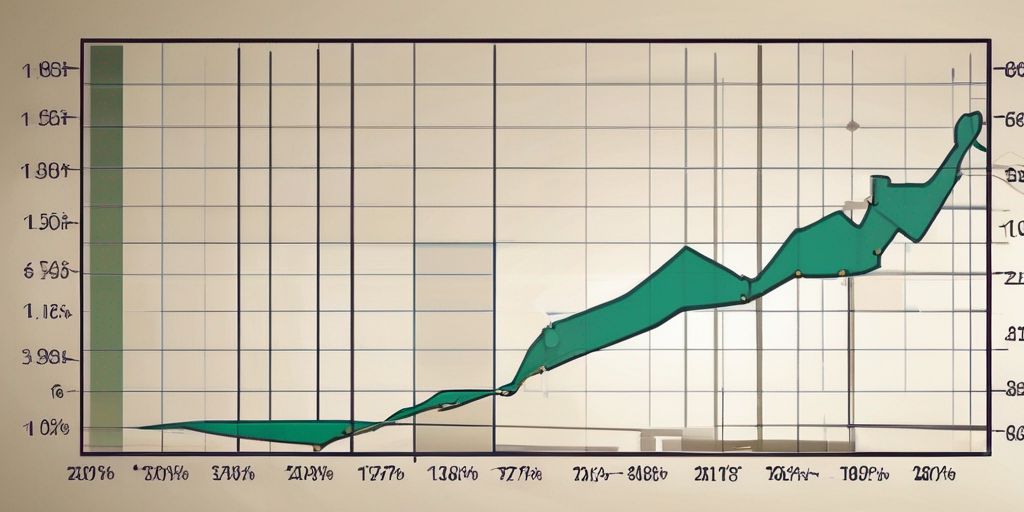

GameStop's stock has seen an astronomical rise, attributed in part to the 'diamond hands' of retail investors on forums like WSB. These investors have held their stakes with the expectation of continued growth. However, experts caution that without owning hardware or content intellectual property, GameStop's long-term sustainability could be at risk, especially as console makers shift towards digital-only models and direct-to-consumer sales strategies.

The metamorphosis of GameStop is a testament to the dynamic nature of the retail and gaming industries. The company's ability to adapt and embrace new technologies like VR and AR could be pivotal in its quest for e-commerce dominance.

While the future is uncertain, the benefits of playing at TopSlotSite.com remain clear. With a wide range of games and a commitment to responsible gaming, it's a platform where entertainment and Safety go hand in hand. Encouragingly, GameStop's journey from games to gains is a narrative that continues to unfold, offering both challenges and opportunities for investors.

Challenges and Opportunities Ahead

18+ BeGambleAware. As we assess GameStop's position in the market, it's crucial to remember the benefits of playing at topslotsite.com, where responsible gaming is always a top priority. GameStop's journey is not without its hurdles, yet it presents a unique blend of challenges and opportunities.

The transition to e-commerce is a double-edged sword. While it opens up vast new revenue streams, it also pits GameStop against formidable online competitors. The company must navigate this shift effectively to secure its place in the digital marketplace.

Customer loyalty will be pivotal in GameStop's transformation. The brand's ability to leverage its existing customer base and attract new gamers with innovative offerings will be a key determinant of its success.

-

**Challenges: **

- Adapting to a digital-first business model

- Competing with established e-commerce platforms

- Managing supply chain disruptions

-

**Opportunities: **

- Capitalizing on the gaming industry's growth

- Engaging with a passionate community of gamers

- Exploring new markets and revenue models

GameStop's ability to balance these challenges with the inherent opportunities will be critical to its investment potential. The company's agility in responding to industry trends and consumer demands will ultimately shape its future.

The Impact of Retail Investors on GameStop's Stock Price

18+ BeGambleAware. When considering the benefits of playing at TopSlotSite.com, it's also worth exploring investment opportunities in the gaming sector. GameStop, once a brick-and-mortar retail chain, has seen its stock price significantly influenced by retail investors. This phenomenon, often driven by discussions on online platforms, has led to volatile swings in the company's market valuation.

Retail investors have played a pivotal role in GameStop's recent market performance. Their collective actions, particularly in buying shares en masse, have sometimes resulted in short squeezes that dramatically increased the stock price. However, these movements are not solely based on the company's financials or business prospects, making the investment riskier.

GameStop's situation highlights the power of retail investors in today's market, but it also underscores the importance of due diligence. Here are some key considerations for potential investors:

- The sustainability of stock price movements influenced by retail investors

- The alignment of GameStop's business transformation with long-term growth

- The potential impact of regulatory changes on market dynamics

While the influence of retail investors can lead to short-term gains, it is crucial for investors to assess the long-term viability of their investments in the context of the company's overall strategy and market trends.

Conclusion

In conclusion, while GameStop has captured the attention of many investors and sparked a wave of excitement in the stock market, it is important to approach investing in GameStop with caution. The volatile nature of meme stocks and the uncertainties surrounding GameStop's long-term sustainability make it a risky investment Choice. As the market continues to evolve, it is crucial to conduct thorough research and consider all factors before making investment decisions. Remember, the key to successful investing is to diversify your portfolio and stay informed. Your financial future is valuable, so make wise choices and invest responsibly. Your feedback is greatly appreciated!

Frequently Asked Questions

What is GameStop's current business focus?

GameStop is transitioning into an e-commerce company to adapt to changing market trends.

Why did GameStop's stock price surge earlier this year?

Millions of investors on WallStreetBets purchased GameStop shares, leading to a massive surge and forcing hedge funds to close their short positions.

What are the challenges GameStop faces in the long run?

GameStop's lack of hardware and content intellectual property may make its business less durable, especially with the rise of direct-to-consumer models by console makers.

Why are retail investors attracted to GameStop stock?

Retail investors see potential for further price increases and enjoy the power to influence markets, despite warnings of artificially inflated prices.

What is GameStop's new initiative in the digital space?

GameStop has launched an NFT marketplace, signaling a shift away from traditional video game sales.

How did retail investors impact GameStop's stock price?

Retail investors, particularly on platforms like WallStreetBets, significantly influenced GameStop's stock price through coordinated buying and short squeeze strategies.